BuildUp 2030 Framework for the Transformation of Real Estate | IMT

What Will It Take? The Path to Carbon Free Buildings by 2050 | IMT

Green is Good Series | Cushman & Wakefield

Environmental Justice and Real Estate | ULI

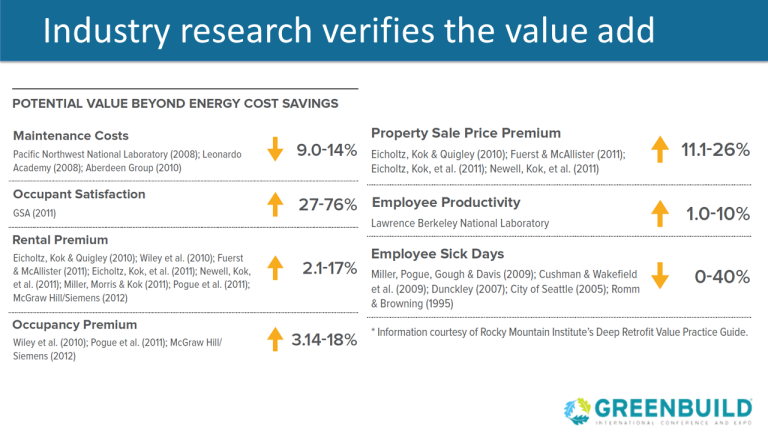

Five Ways that ESG Creates Value

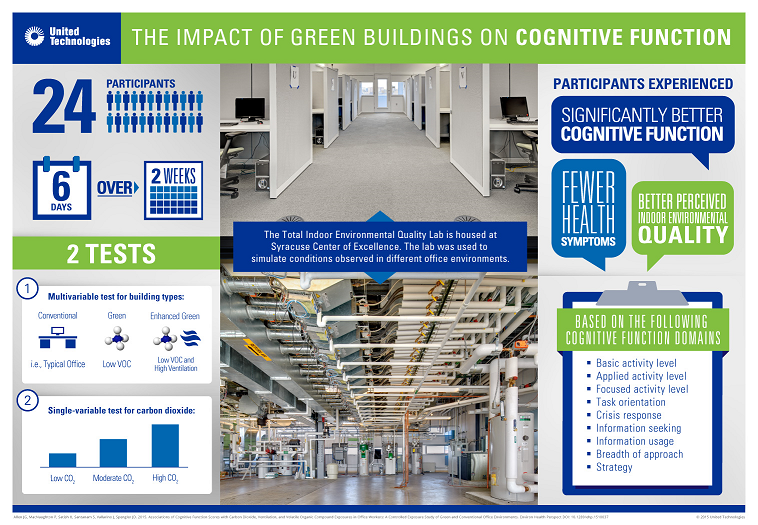

Financial Impact of Healthy Buildings

NBI: 2020 Getting to Zero Buildings List

Building the Financial Business Case for Resilience (cont. by CSS)

Optimizing Community Infrastructure (cont. by CSS)

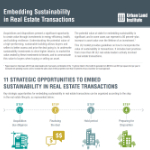

Embedding Sustainability (cont. by CSS)

Best Practices for Leasing NZE Buildings (cont. by CSS)

G4 Reporting & Disclosures

Sustainability Disclosure

DOE Business Case for Retrofitting

DOE EIA Energy Outlook 2015

Unlocking ROI

UNEPFI Sustainability Metrics

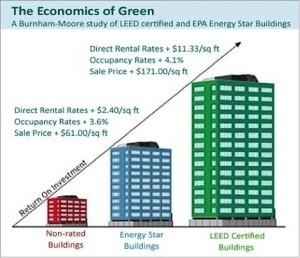

Economics of Green Retrofits

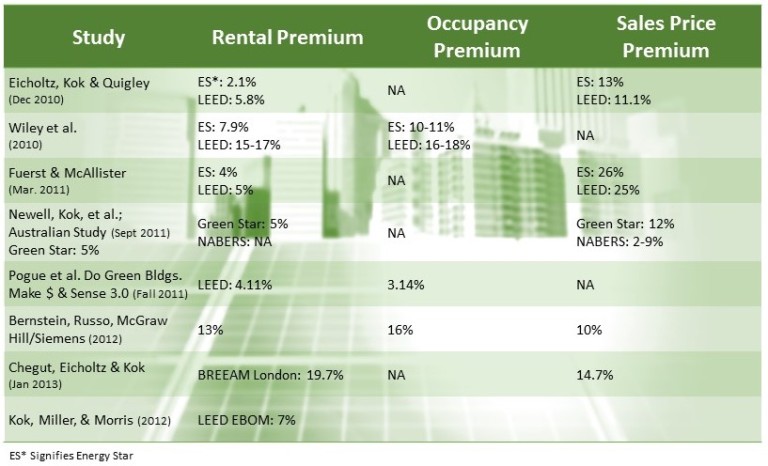

Studies that Prove the Business Case

PWC Sustainability Valuation

Oracle Energy Paper

Value of Green Buildings

MSCI World ESG Index

Managing Indoor Air Quality Roundtable

Managing Indoor Air Quality Briefing

LEED Adobe Statistics 2013

Investor Strategies for ESG

Green Building Asset Valuation

Green Building Adoption Index 2014

Does Green Pay Off?

Deloitte Breakthrough for Sustainability

Business Case For Green Building

Assessing Value of Green Buildings

2011 EEI IFMA Results Report