Jan 12, 2023 | Events, Homepage

2022 Progress Report and a Look Ahead for 2023

Part of Duane Morris LLP’s Environmental, Social and Governance (ESG) Webinar Series

About the Program

Among nonfinancial criteria, businesses must increasingly consider ESG (Environmental, Social and Governance) to stay relevant to their employees, customers, and boards.

Beyond making smart business sense, ESG initiatives can help drive efficiency, increase engagement, and involve constituents in critical ecological and social improvements.

Increasingly, investors, shareholders, and money managers want to know a company does more than just turn a profit; indeed, having a positive impact on the world at large is often a metric used to gauge the long-term health and viability of a commercial enterprise. Investments in real estate and development are now being evaluated for ESG sustainability by and for players in capital markets.

With 2022 behind us, we will review major developments and stories from the past year―as well as share our hopes and predictions for what 2023 might have in store.

Panel

Location, Date & Time

Online webinar

January 25, 2023

12:00 PM ET

More information about Duane Morris LLP.

Nov 18, 2022 | Events, Homepage

As the demand for ESG initiatives and reporting from stakeholders continues to rise, mechanisms for quantifying progress are becoming increasingly popular.

The GRESB (formerly known as the Global Real Estate Sustainability Benchmarking) assessment supports fund managers and asset operators with measuring and benchmarking their ESG performance impact. The Green Building Initiative (GBI) is hosting a 60-minute webinar to promote the widespread adoption of sustainability and ESG in the built environment. Attendees will learn about this standardized, globally recognized framework and how it can improve your investor-manager engagement and compare ESG related policy, programs, and performance against peers. Varia US/Stoneweg US will detail the process for their first GRESB assessment submittal, and how it identifies areas of opportunity for improvement.

Learning Objectives

- Understand that the market drivers for increased interest in ESG & GRESB reporting.

- Describe how GRESB can be used as a framework to improve transparency and can help identify opportunities for performance improvement.

- Recall the Varia US/Stoneweg US GRESB performance results and identify the challenges and benefits of preparing for submittal.

- Recognize that GBI can support stakeholders in improving sustainability, health & wellness, and resilience in the built environment through certification efforts recognized by GRESB.

Register Now

Oct 14, 2022 | Articles, Homepage

Originally published by Institute for Market Transformation on 10/13/2022

https://www.imt.org/news/partner-spotlight-corporate-sustainability-services/

What are the market opportunities you see that enable you to better serve clients as demand grows for better buildings?

The growing interest in ESG more broadly, to include high-performance, sustainable, healthier, safer, and more resilient buildings allows us to help organizations define for themselves what ESG and better buildings actually look like. Because companies, communities, portfolios, and buildings are all unique, we see integration of sustainability/ESG best practices as an opportunity to not only create value but also have a meaningful impact environmentally, socially and financially.

How do you utilize and respond to building performance and climate policy in your work?

Mainly we’re helping our client navigate the complexity, particularly given that the level of change has been staggering. Our clients appreciate our ability to not just provide insights, perspective, and expertise, but also expediency. We help them move more nimbly, more quickly and yet do so with more confidence to work towards and achieve their goals.

How does collaboration drive your business?

Collaboration is critical. One thing I love about the sustainability/efficiency/ESG space is that people are more than willing to share knowledge, lessons learned, and best practices – and this collaboration makes all the difference. It’s the ability to connect with other leaders and partner with other organizations that allows us to scale and better serve our clients – too it’s what makes our work so rewarding and fun!

What industry trends are you most watching now?

Public policy, disclosure framework evolution and regulatory related changes are front and center for us and our clients. Too, how these changes connect with decarbonization and our clients’ interest in carbon neutrality, has gone from “not interested” three years ago to “completely engaged” now. The SEC’s proposed rule changes (and even additional rules being considered), the Sustainable Finance Disclosure Regulation (SFDR), Task Force on Climate Related Financial Disclosure (TCFD)… there are too many to name and for most of our clients, these present challenges with “how to understand and digest” and more importantly understand the right way to address and prepare for these changes.

What is one of the biggest untapped opportunities in your industry when it comes to addressing the climate crisis via buildings?

Better understanding of what climate related physical and transition risks actually are and mean for real estate investors, owners and operators. It’s one thing to know there are growing risks, and even to have software solutions to assess those risks, but it’s quite another thing to know how to respond to the information and integrate into both business processes, execution, and properties themselves to garner greater resilience.

Aug 16, 2022 | Events, Homepage

Presented by BOMA Fort Lauderdale & Palm Beaches

Session Information

Investors are increasingly asking about it, and large corporate tenants are announcing commitments around carbon neutrality. The conversation is moving past just certifications and efficiency and into actual decarbonization. This presents building owners, operators and building engineers with an opportunity to cost-effectively develop a plan for net zero. Hear Brenna Walraven discuss the market context for the growing interest in ESG and decarbonization, provide high-level definitions for what carbon neutrality means, as well as basic steps and business cases for taking action.

Speaker

- Brenna S. Walraven, CEO, Corporate Sustainability Strategies (CSS)

When

September 21, 2022

11:30 AM – 1:30 PM

More Information & Registration

About BOMA

Building Owners and Managers Association (BOMA) Fort Lauderdale & Palm Beaches has 325+ members who own, operate, or service millions of square feet of office, industrial, medical office, retail, and mixed-use properties in Broward, Palm Beach, and Martin Counties. We understand that excellence in management directly impacts the quality and value of a commercial real estate asset.

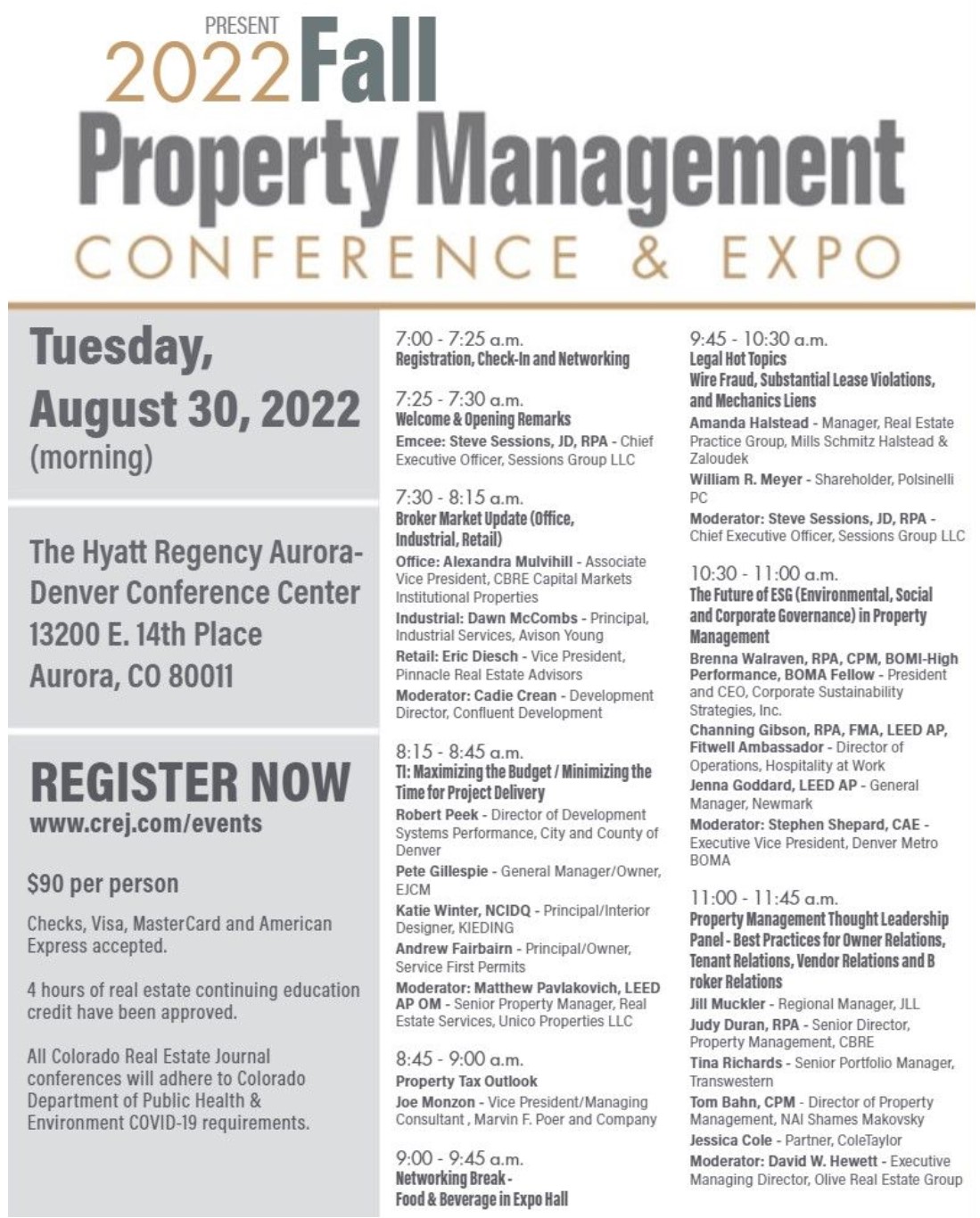

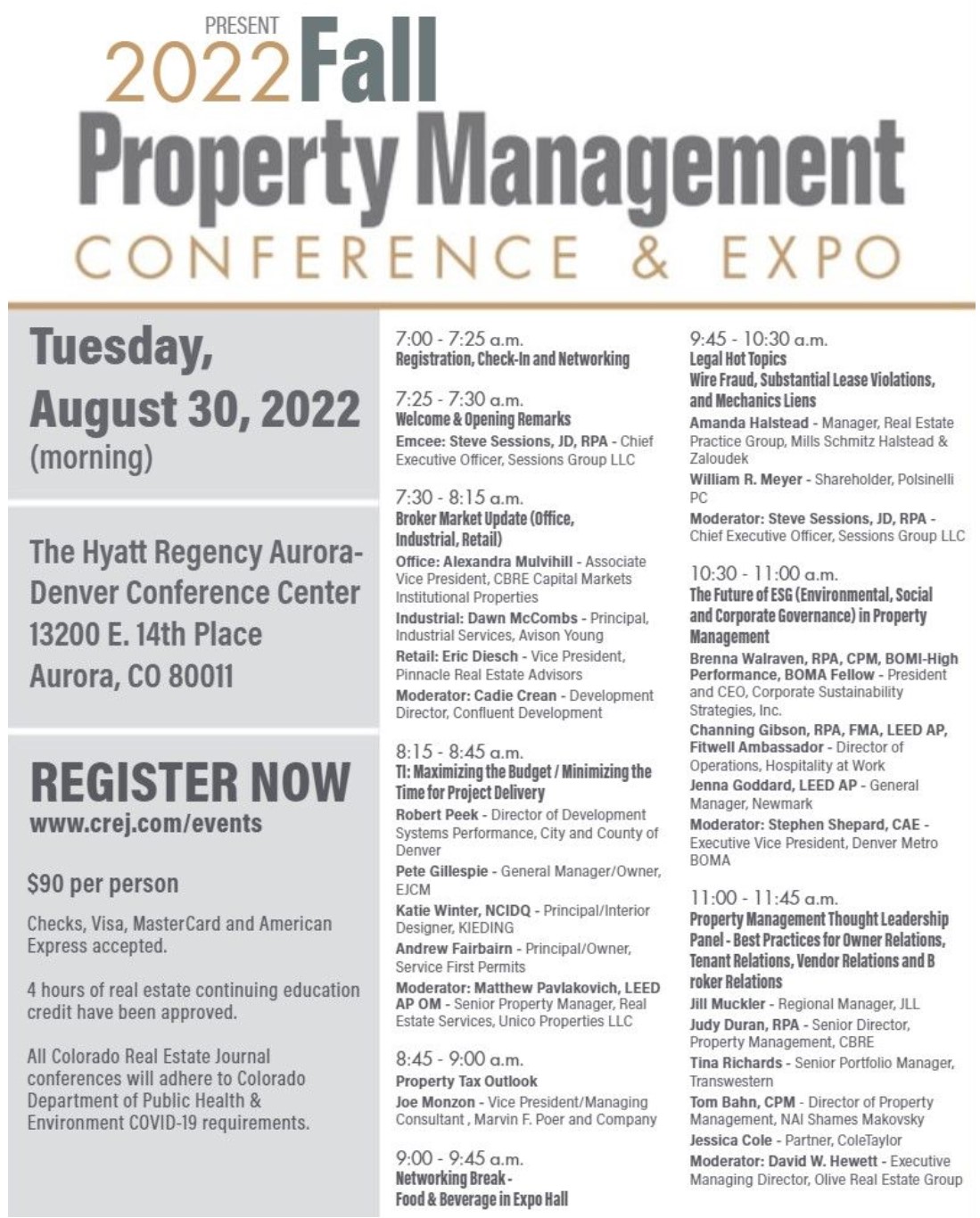

Aug 14, 2022 | Events, Homepage

Presented by BOMA Denver & Colorado Real Estate Journal

Panel

- Channing Gibson, Director of Operations, Hospitality at Work

- Jenna Goddard, LEED AP, General Manager, Newmark

- Stephen Shepard, CAE, Denver Metro BOMA

- Brenna S. Walraven, CEO, Corporate Sustainability Strategies (CSS)

When

August 30, 2022

10:30 AM – 11:00 AM

More Information & Registration

About BOMA

Building Owners and Managers Association (BOMA) Denver advances the commercial real estate industry through advocacy, professional development and the exchange of knowledge.

Jul 14, 2022 | Articles, Homepage

Corporate Sustainability Strategies joins Institute of Market Transformation’s as Ally Partner to increase awareness of building performance standards requiring energy efficiency in commercial buildings

HUNTINGTON BEACH, Calif., July 14, 2022 – Corporate Sustainability Strategies (CSS) has joined the Institute for Market Transformation (IMT), a nonprofit that collaborates with building owners, tenants, governments, and others to promote energy efficiency in buildings.

“CSS is honored to be an IMT Ally Partner,” said Brenna Walraven, President and CEO, CSS. “Investors are increasingly requiring greater environmental, social, governance and resilience (ESG+R) transparency and performance benchmarking. We look forward to collaborating with IMT and bringing greater awareness of building performance standards (BPS) to address building efficiency as a means to reduce carbon emissions, and better community health, resilience, and economic opportunity.”

A BPS policy can include multiple standards, each targeted to increase performance for a different type and/or aspect of a building. These can include energy, gas and water use, as well as emissions and peak energy demand. These targets become stricter over time, driving continuous, long-term improvement in building stock. BPS complements and makes building energy codes accountable; the two work in tandem to improve building performance.

“ESG practices fall squarely into ‘the right thing to do’ category for not only a company’s ESG+R obligations but for their bottom lines,” Walraven said.

Resources

About IMT

The Institute for Market Transformation (IMT) is a national nonprofit organization focused on increasing energy efficiency in buildings to save money, drive economic growth and job creation, reduce harmful pollution, and tackle climate change. For more information, visit imt.org.

About CSS

Corporate Sustainability Strategies is commercial real estate sustainability consulting firm. Services are client-centric, focused on driving enhanced financial returns by designing and implementing cost effective ESG+R strategies. For more information, visit corporatesustainabilitystrategies.com.

###