Jun 10, 2024 | Articles, Homepage

We invite you to explore and reflect on our past and to join us in shaping a sustainable future because every day should be World Environment Day.

This timeline traces the journey of conservation, environmentalism, and sustainability from as far back as the 1600s, spotlighting the milestones and achievements that have shaped our understanding and practices of sustainable living. It’s a celebration of our collective progress, a tribute to the pioneers who have led the way, and a reminder of the work that still needs to be done.

Start your journey through the history of sustainability here.

Source: retechadvisors.com/timeline-of-sustainability

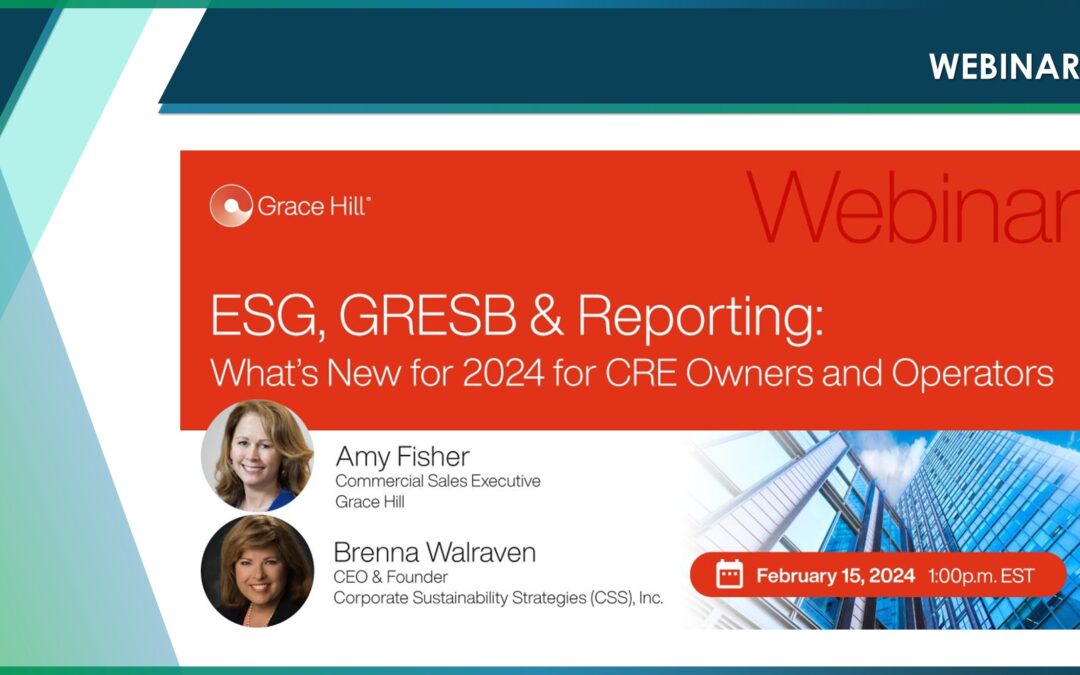

Feb 8, 2024 | Events, Homepage

Learn why ESG and GRESB matter more than ever and how they can influence your bottom line.

About

Global events, climate-related disruptions, social change, and increasing legislative and regulatory trends continue to propel the importance of Environmental, Social, and Governance (ESG) in real estate.

Investors are evaluating and adopting a more strategic approach to sustainability, and commercial real estate owners and operators are finding significant value in incorporating ESG best practices into existing real estate strategies. And in many cases, owners, investors, and operators are also utilizing GRESB (formerly known as the Global Real Estate Sustainability Benchmark) reporting to become more transparent about ESG programs, progress, and performance.

We invite you to join Grace Hill’s upcoming webinar, “ESG, GRESB & Reporting: What’s New for 2024 for CRE Owners and Operators,” where we will take a deeper look at the impact and evolution of ESG, GRESB, and Reporting with Brenna S. Walraven, an internationally recognized leader in commercial real estate and sustainability, and Amy Fisher, a real estate thought leader with Grace Hill.

During this informational webinar, owners and operators will learn about:

- Marketplace context for ESG.

- Clearer definitions of ESG terms and acronyms.

- Components of an effective ESG strategy.

- Benefits of participation and changes to GRESB.

- Engagement pathways and resources.

Date & Time

Thursday

February 15, 2024

10:00 AM – 11:00 AM PST

Register Now

Register Now

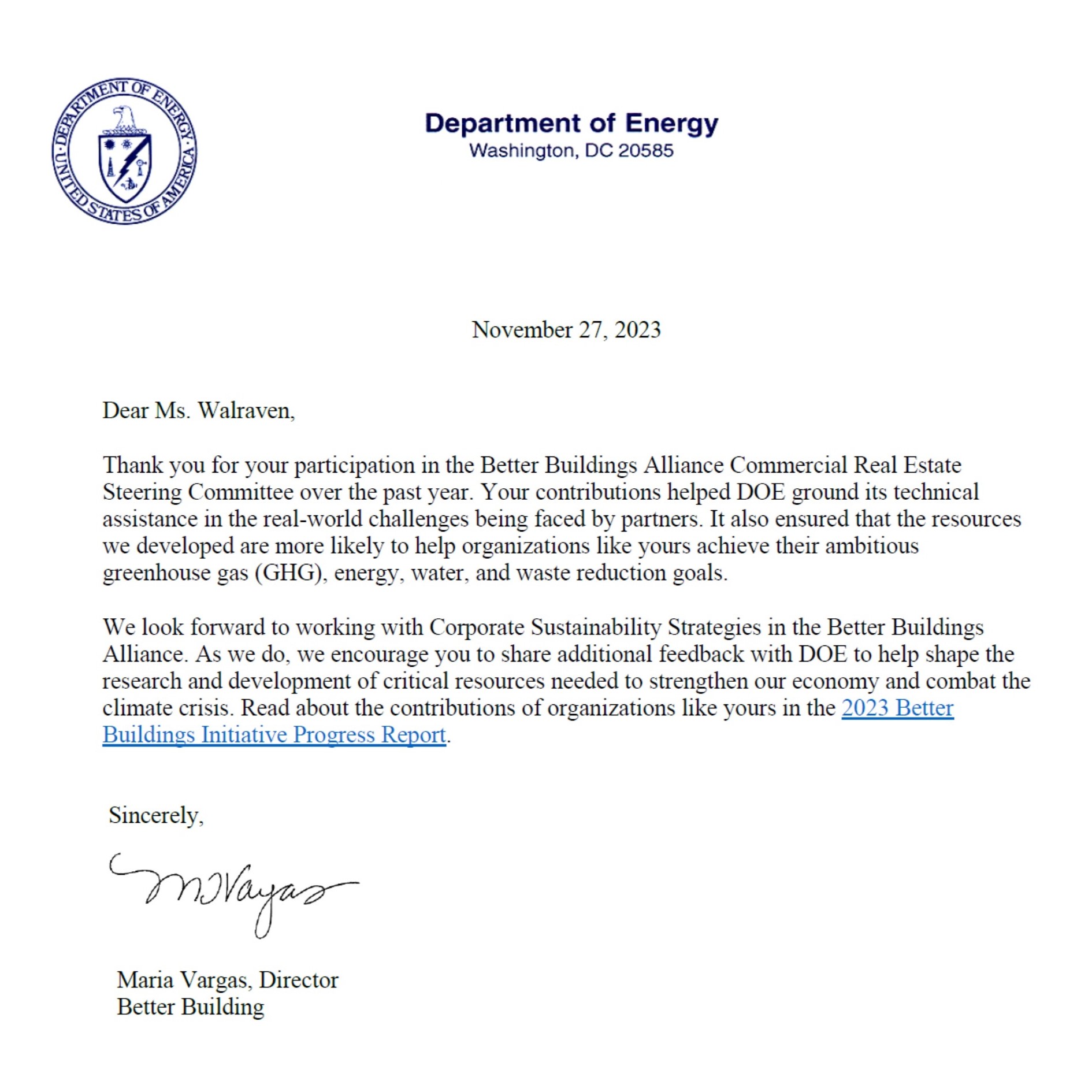

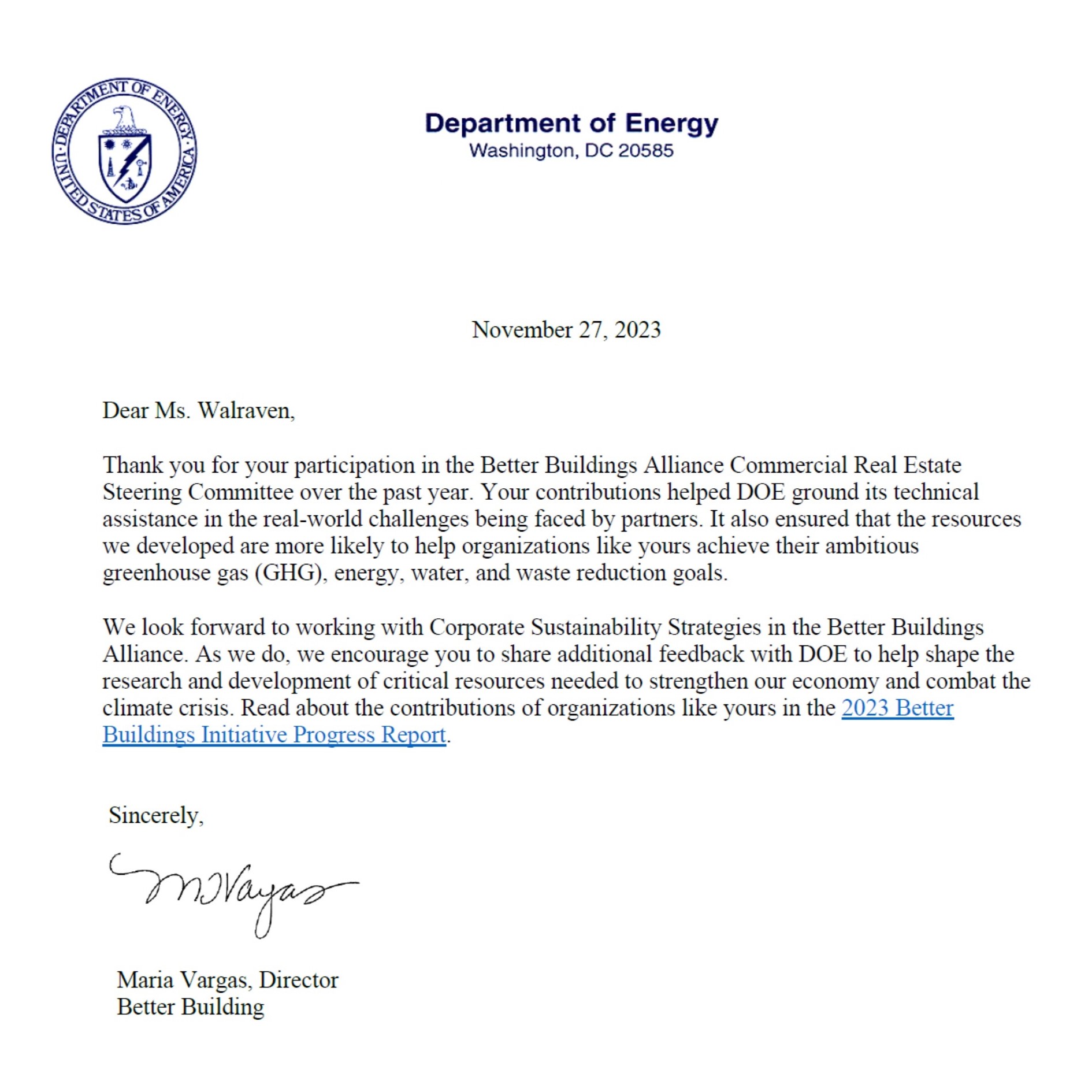

Jan 10, 2024 | Articles, Homepage

We are truly honored to serve the Better Buildings Alliance Commercial Real Estate Steering Committee by exploring barriers of decarbonization and sharing best practices on how to overcome them.

Read about the contributions of many organizations in the 2023 Better Buildings Initiative Progress Report.

Oct 24, 2023 | Events, Homepage

There is a common concern that incorporating sustainability in new developments and existing renovations is cost-prohibitive. However, numerous green finance initiatives exist to address this challenge. This session will explore several approaches to green finance for the real estate sector: green bonds, green loans, C-PACE loans, IRA funding, and other local green financing mechanisms. In addition to a short overview of each, real estate practitioners will highlight specific use cases that demonstrate the diverse opportunities for financing low-carbon projects to make the business case that enables accelerated building decarbonization.

register

Jun 22, 2023 | Events, Homepage

GRESB—an organization that provides and benchmarks ESG data based on a rigorous methodology—provides a powerful framework by which organizations can measure their ESG achievements. Formerly known as the Global Real Estate Sustainability Benchmark, GRESB provides building owners and managers with a can’t-miss opportunity to improve not only ESG metrics, but financial performance. Hear real estate professionals discuss how GRESB can be used to meet sustainability and financial goals.

register

Apr 17, 2023 | Articles

Over 1 billion individuals in 193+ countries mobilize for action every Earth Day. World climate leaders, grassroots activists, nonprofit innovators, thought leaders, industry leaders, artists, musicians, influencers, and leaders of tomorrow are all involved.

“Invest In Our Planet” is Earth Day’s 2023 theme, and in recognition of Earth Week, here are 52 daily actions and tips to make a difference every week (and day) of the year.

Also, we also encourage you to explore Green Seal’s certified products, facilities, and companies. For more than 30 years, they have accelerated market adoption of products and services that are safer for people and the planet and are uniquely positioned to help shift our economy from toxic to sustainable.